Key Points

- The IAIS has issued a detailed analysis of the structural shifts in the life insurance sector related to the increasing allocation to alternative assets and prevalence of asset-intensive reinsurance transactions. These trends offer significant benefits but are also said to introduce risks that require robust risk management and supervisory oversight.

- The IAIS paper underscores the importance of macroprudential and financial stability considerations, given the interconnectedness of life insurers with other financial institutions and potential contagion risks. The IAIS’ review of its supervisory materials aims to ensure that its supervisory approach remains effective in addressing the challenges posed.

- The IAIS paper is an important step towards understanding the risks associated with the evolving investment strategies in the life insurance sector globally and how they may be managed. The IAIS encourages stakeholders to provide feedback on the draft paper to further refine its approach and ensure the stability and resilience of the global insurance market.

- The paper should be read carefully by insurers, reinsurers and asset managers who provide services in the sector. It provides an important appraisal of current and likely future regulatory trends for alternative asset investment in the sector and asset-intensive reinsurance transactions.

The International Association of Insurance Supervisors (IAIS) published a draft consultation paper on 19 March 2025 on structural shifts in the life insurance sector. The paper covers four areas:

Alterative assets. Life insurers are increasingly allocating investments to alternative assets such as private equity, real estate, infrastructure, hedge funds and private debt. This shift is driven by the need for higher returns and diversification, especially in a prolonged low-interest-rate environment. While alternative assets offer benefits like diversification and higher potential returns, they also introduce significant risks, including valuation uncertainty, illiquidity and complexity. The IAIS proposes a principles-based definition for alternative assets to address these challenges and facilitate cross-border risk assessments.

Asset-intensive/funded reinsurance (AIR). AIR transactions involve transferring significant investment risks associated with insurance liabilities to a reinsurer. These arrangements are particularly prevalent in asset-intensive products like annuities and universal life insurance. AIR offers benefits such as risk reduction, capital relief and indirect access to a broader universe of investable assets. However, it is also said to present risks involving recapture, concentration and increased complexity.

Macroprudential and financial stability considerations. The IAIS examines the macroprudential and financial stability implications of the increased investments in alternative assets and the adoption of AIR transactions. The IAIS notes the primary aim of macroprudential policy for the insurance sector is to ensure that the financial system and insurers can absorb, rather than amplify, adverse shocks. While the current exposure to alternative assets and AIR is relatively small, the rapid growth in these areas could increase financial stability risks. Enhanced frameworks and international cooperation are essential to manage these evolving risks.

Review of IAIS supervisory materials. The IAIS review found that its Insurance Core Principles (ICPs) and Common Framework for the Supervision of internationally active insurance groups address risks that could potentially arise from increased capital allocation to alternative assets and AIR. It does identify potential areas for enhancement, including improving information sharing amongst supervisors, managing conflicts of interest, ensuring competence in risk management, and adapting supervisory review and reporting to better monitor complex assets and reinsurance agreements. The IAIS emphasises the importance of considering macroprudential supervision and financial stability in its supervisory approach.

This article touches upon each of the four focus areas but with a predominant analysis of AIR transactions and the IAIS’ views. The IAIS consultation is open for comments until 19 May 2025.

Alternative Assets

In relation to AIR transactions, the IAIS notes that there a trend of life insurers increasing their allocation to alternative assets. This trend has continued even as interest rates have risen, indicating that factors beyond the interest rate environment are influencing investment strategies.

The global supply of alternative assets has been consistently increasing over the last two decades, driven by investor demand for diversification and higher returns, the growing number of alternative investment managers, technological advancements and regulatory changes. Insurers are particularly active participants in this market, seeking to diversify their portfolios, improve returns, and better match their liabilities. However, the lack of a common definition for alternative assets and differing regulatory frameworks across jurisdictions complicate cross-border risk assessments and reduce comparability in insurers’ financial statements. The IAIS also examines regulatory requirements, risk management and banking for their relevance for insurers (and the potential transfer of assets between sectors).

To address the challenges of defining and regulating alternative assets, the IAIS proposes a principles-based definition focusing on valuation uncertainty, illiquidity and complexity. This approach aims to build a common understanding amongst supervisors and facilitate cooperation across jurisdictions, because one of the main challenges in regulating alterative assets is the lack of a universal definition. The principles-based definition includes assets that display a high degree of valuation uncertainty, illiquidity, or complexity, or a combination of these characteristics.

Alternative assets offer several benefits to insurers, including diversification, higher potential returns, market sophistication, capital optimisation, alignment with long-term liabilities and hedging against inflation. These assets often have low correlation with traditional investments, providing unique sources of investment return and additional yield. They also allow insurers to invest in the real economy, supporting economic growth and development.

Despite the benefits, alternative assets introduce significant risks that require robust management. Key supervisory concerns include valuation uncertainty, hidden leverage, liquidity risks, links to private equity firms and conflicts of interest, credit risk and credit ratings, regulatory capital-related issues, increased complexities around the management of alternative assets and information gaps.

The shift towards alternative asset investments has broader macroeconomic implications. Insurers’ investment behaviour is influenced by economic cycles and market sentiment, which can lead to procyclical investment patterns. During economic expansions, insurers may allocate more capital to higher-risk alternative assets, potentially driving up asset prices and leading to overvaluation. Conversely, in economic downturns, insurers may withdraw from these investments, exacerbating market downturns and liquidity shortages.

AIR

The IAIS has monitored structural changes over the last four years within the life insurance sector through its Global Monitoring Exercise (GME). A primary focus has been the industry’s increasing allocation to alternative assets and the rising adoption of cross-border AIR. Through the GME, the IAIS has identified AIR as an increasingly popular tool for transferring risk in the life insurance sector.

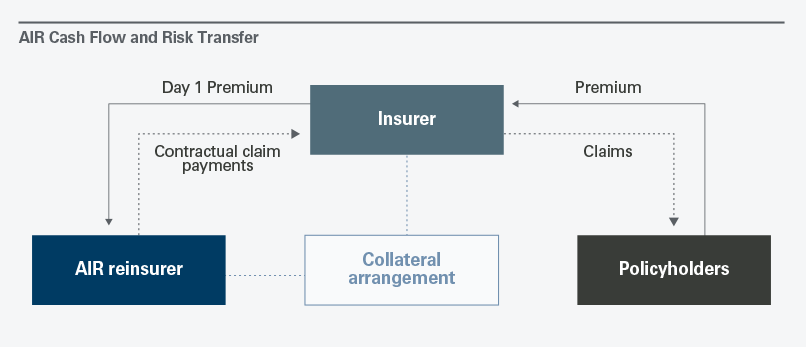

Structure of a Funded Reinsurance Transaction

AIR is a reinsurance risk-transfer arrangement whereby significant investment risks associated with insurance liabilities (such as longevity or mortality) are transferred to a reinsurer. These arrangements are typically associated with insurance products that expose the insurer to relatively more significant investment risk than biometric risk, and which involve large upfront premium payments. The reinsurer, or an appointed manager, manages the invested assets to fund future claims and increase profit margins.

The cedent (insurer) benefits from risk reduction, capital relief and indirect access to a broader universe of investable assets. The counterparty benefits from growth in assets under management, potential profit from higher investment returns and leverage of their investment expertise.1

AIR transactions can be unaffiliated (where the cedent and reinsurer are unrelated) or affiliated (both within the same group). Regulators devote particular scrutiny affiliated transactions. In particular, affiliated reinsurance agreements will usually be subject to additional checks and balances such as pre-approval or notification to ensure they are conducted at arm’s length and provide discernible economic benefits.

AIR arrangements are priced by the reinsurer based on the investment universe in which they operate, permitting higher returns on the investment of collateral, amongst other factors. If a reinsurer can invest in higher-yielding assets than the cedent (perhaps alternative assets and those available in international markets), the reinsurer can offer attractive pricing to the cedent.

However, a recapture risk arises if the cedent needs to take back the assets which may not be adequate or sufficient to align with its investment strategy or regulatory requirements, which could cause the cedant a loss. Collateral structures where the assets are held on the balance sheet of the cedent and are therefore (by default) compliant with the cedent regulatory regime carry less risk associated with recapturing the supporting assets, though the risk associated with re-establishing required capital remains.

Cedants also manage recapture risk and counterparty default risk by having diverse panels of reinsurers with adequate credit ratings or parental support, supported by detailed investment guidelines.

Termination events in AIR agreements help manage and mitigate risks for both the cedent and reinsurer by specifying conditions which would trigger termination. Examples include: breaches of solvency ratios, insolvency, ownership changes and failure to meet payment obligations. Agreements commonly contain early warning triggers ahead of an insolvency that dictate remedial steps a reinsurer may take.

The IAIS notes that retrocessions may further add to the complexity of a transaction. Mortality and longevity risk can be further retroceded to a retrocessionaire or to a reinsurance sidecar.

Collateral Arrangements

Collateral arrangements themselves are highly specific and negotiated on a transaction-by-transaction basis. Collateral levels are negotiated and recalculated regularly to ensure they meet the required balance. Terms may include over-collateralisation and haircuts based on asset risk. There are several options in respect of such arrangements:

- Coinsurance with assets transferred: The simplest form is where the premium is paid directly to the reinsurer and no separate ring-fencing of collateral is put in place.

- Coinsurance with trust: Similar to the simple form above but assets are placed in a trust account. The cedant is named as a beneficiary and a neutral third party (such as a custodian bank) holds custody of the trust. This allows of more transparency for the cedent, as the reinsurers assets are segregated for this purpose. On recapture, the cedent can take direct control of the trust account and the assets therein. It is important that the regulatory regime of the trust is consistent with that of the cedent.

- Coinsurance with funds withheld: Assets continue to be held on the cedent’s balance sheet and are owned by the cedant but are held in a segregated account and may be managed by the reinsurer. Periodic settlement with the insurer is similar to coinsurance with assets transferred but with an addition or deduction depending on income earned or lost on the assets. More operational support is required from the cedent for accounting for this and the reinsurer will be designated as a subadvisor for the investment management.

- Modified coinsurance: This structure primarily exists in the US and is structurally similar to funds withheld, however the cedent retains both assets and reserves on its balance sheet from an accounting, legal and regulatory perspective. Periodic settlements with the reinsurer mirror those of coinsurance with funds withheld with an additional modified coinsurance adjustment which is equivalent to any investment income or loss earned on the assets minus changes in statutory reserves.

Why Is AIR Becoming More Prevalent?

Some common considerations which could lead to the desire to implement an AIR transaction, aside from the direct impact of insurance supervision, include:

- Flexibility in capital raising: Public markets have proven to be limited sources of capital for growth, and AIR allows insurers to access investors that can provide capital for growth and opportunistic deals.

- Taxation: Favourable tax frameworks in certain jurisdictions can make AIR more attractive. Assuming liabilities in a jurisdiction with a favourable tax framework can minimise a reinsurer’s overall tax liability.

- Supervisory recognition and other factors: Jurisdictions with established reciprocal approaches to supervision may be preferred for AIR transactions.

Reserving, Capital Requirement, and Investment Flexibility: Jurisdictional Considerations

Regulatory frameworks for reserving, capital requirements and investment flexibility vary across jurisdictions. Those differences can drive AIR activity as insurers seek more favourable conditions. The IAIS paper includes on page 42 a helpful table summarizing requirements across some popular jurisdictions.

One point to note is that the interaction of insurance liabilities and capital may differ between jurisdictions, as different jurisdictions may address similar risks but in different places. For this reason, some supervisors have adopted a Total Asset Requirement measure, which includes required liabilities, capital requirements and buffer, in order to make a like-for-like comparison. Another key difference is in supervisors’ approach to investment flexibility. Some jurisdictions have principle-based frameworks, granting flexibility in investment choices, subject to guardrails or safeguards. Others may have more prescriptive limits, or a combination of principles and prescription.

The IAIS has also looked at differing approaches to reserve valuation, in particular methods for determining cashflow assumptions, discount rates and additional reserves.

In respect of cashflow assumptions, some jurisdictions such as the US use prescribed assumptions, while others allow for more economic assumption-setting, such as the UK, EU and Bermuda. This means the insurer will set its own cash flow assumptions, subject to significant internal and external review, based on credible insurer experience data. Such a difference in approaches may result in a significant differences in liability valuations where the insurer and reinsurer are regulated under different regimes.

For discounting, the IAIS notes the discount rate or curve used in the calculation of liabilities is a key component to the overall valuation and solvency. Some jurisdictions fix their discount rate at the inception of an insurance contract. For example, in the US, discount rates vary by product type but are “locked-in” at inception of the contract. In other jurisdictions, such as Japan, there is a market-based approach where discount rates are updated frequently based on economic assumptions at the valuation date. This adds volatility to the calculation but it will remain market-consistent, particularly where the assets are held at market value and updated at the same frequency.

Another approach which can affect the calculation of liabilities is whether a yield uplift above the risk-free rate is a key component of the discount curve. Market consistent jurisdictions such as Bermuda, the EU and UK, publish discount rates periodically. In addition, some jurisdictions such as Bermuda, the EU and UK, allow insurers to use a discount rate based on the adjusted expected returns of the asset portfolio backing the liabilities.

Likewise, approaches to capital requirements vary across jurisdictions. This may be by way of a standard method or an internal model but, whichever method is employed, the resulting capital charges are intended to ensure that insurers hold sufficient capital to cover potential losses arising from different types of risks, such as underwriting, market, credit and operational. The time horizon for which the capital requirements should cover unexpected losses also differs by jurisdiction.

As mentioned above, there is differing investment flexibility globally, ranging from prescriptive rules to principle-based approaches like the Prudent Person Principle (PPP). These differences particularly impact cross-border AIR and considerations related to recapture risk. If a recapture occurs across jurisdictions, assets may be recaptured into a jurisdiction in which those assets are less understood, do not follow rules regarding asset-liability management, or are even restricted or disallowed, introducing an additional layer of complexity to ceding supervisors.

The IAIS therefore observes that one of the key drivers of growth in AIR is the ability to leverage jurisdictional differences in reserving, capital requirements and investment flexibility. Several specific drivers are also identified by the IAIS:

- Investment flexibility and cost of capital: Third-party AIR transactions may benefit from the reinsurer’s greater investment flexibility and lower cost of capital, leading to improved reinsurance pricing for the ceding insurer.

- Appetite for legacy blocks: Third-party AIR ceding insurers may use AIR to exit legacy blocks of business, allowing them to focus on priority products. AIR reinsurers are showing an increased appetite for legacy blocks.

- Preference for market-consistent regimes: Affiliated AIR transactions may prefer transferring risks to market-consistent regimes, which allow for better risk measurement and hedging, reducing redundant capital and reserving requirements.

- Access to capital markets: Affiliated AIR transactions may also be driven by the need for access to capital and financing markets, particularly where one jurisdiction has better access to global investors.

The economic drivers of AIR can vary and may also change over time as market conditions, asset portfolios and liabilities evolve. Cedents should continually review their reinsurance programme to ensure alignment with their ongoing risk appetite as their business strategies evolve in response to internal and external factors.

Supervisory Concerns and Responses

The IAIS delves into the supervisory concerns and responses related to the rising adoption of AIR transactions in the life insurance sector. This section is crucial as it outlines the key risks identified by supervisors and the measures being taken to address these risks. Globally supervisors have identified several key concerns related to AIR transactions:

- Motivation for AIR: The primary concern is understanding the true motivation behind AIR transactions. While AIR can be used for capital, risk and financial management, it is difficult to identify the key benefits and drivers of value. This is particularly challenging when AIR arrangements leverage differences in regulatory regimes. Supervisors of cedents will be keen to ensure that that these arrangements are not being used to circumvent local prudential rules.

- Increasing complexity: AIR arrangements and associated collateral structures are becoming increasingly complex, as they evolve constantly in structure and assets eligible for inclusion in collateral pools. This complexity demands significant attention from cedent supervisors to identify all risks and potential prudential impacts on the ceding insurers. Supervisors may need to navigate cross-border legal, tax, prudential and accounting implications, which requires engagement with regulators.

- Concentration risks: There is a concern about the concentration of AIR transactions amongst a limited number of reinsurers and jurisdictions. This concentration could pose systemic risks and requires attention from insurers and supervisors to ensure stability.

- Recapture risk: Recapture risk arises if the AIR arrangement fails, and the cedent needs to take back the assets. This presents challenges due to the potential inadequacy and insufficiency of the collateral assets, the availability of capital to back recaptured risks, and the operational complexities associated with recapture. The IAIS includes an example from the Prudential Regulation Authority in the UK on the impact of recapture which shows two key impacts: (1) the reinsurance assets are derecognised and the collateral assets are recognised on balance sheet, and (2) the capital requirements are increased to reflect the risks that were originally managed by the reinsurer but have been recaptured in the cedent. This would have a material impact on the solvency ratio (taking the worked example from a 473% SCR to a 75% SCR).

- Knowledge gaps: Supervisors may lack understanding of changing prudential frameworks in different jurisdictions, which can hinder effective supervision. Bridging these informational divides is required.

- Information exchange obstacles: Limited information exchange can hamper a holistic understanding of risks. Enhanced mechanisms for collaborative efforts and information sharing are needed.

- Interplay of profitability goals: In corporate structures where the asset manager and reinsurer are part of the same group, the asset manager’s profitability goals may influence the reinsurer’s risk appetite, potentially creating conflicts of interest.

- Compliance with accounting standards: Ensuring compliance with accounting standards and the adequacy of methods and frequency of reviews is a question to consider with respect to reserving.

- Distinguishing retained assets: Differentiating between assets supporting ceded and retained liabilities in financial statements can be challenging, necessitating clarity and transparency in financial reporting.

Group Consolidation

Group consolidation approaches vary across jurisdictions, affecting the accounting and supervision of intra-group AIR activities. Regardless of the approach, the objective of group consolidation is to analyse solvency and capital adequacy of the group, with special attention to intra-group transactions and the fungibility of capital between entities within an insurance group.

- US. The US does not have a prescriptive consolidation methodology for group financial statements. It looks at the combination of group financial statements prepared under local requirements (such as GAAP) along with legal entity statements. The US also uses its calculation for group capital to assess capital adequacy at a group level.

- Hong Kong. Hong Kong does not prescribe a basis for consolidation but provides principles and guidance for aggregation, including the elimination of double counting of capital. Groups are required to submit financial statements and group capital adequacy reports prepared under IFRS.

- UK/EU. Solvency II and Solvency UK prescribe group-wide capital standards by way of specific rules regarding the consolidation of multiple entities. This can involve full consolidation with consideration of intra-group transactions or the possibility of a deduction and aggregation method when full consolidation is not appropriate.

- Bermuda, Singapore and others. Bermuda and Singapore, and others, utilise consolidated financial statements prepared in accordance with local standards, with prudential filters to align with valuation and capital frameworks.

Group-Wide Supervision

Organisational structures can add complexity to the accounting, monitoring, and supervision of affiliated AIR transactions, especially for groups with subsidiaries in different jurisdictions or intra-group AIR activities. Jurisdictions in the survey sample were asked how group-wide supervision tools help monitor AIR and how current supervisory tools and practices can be adapted to incorporate critical aspects of these agreements.

- Group-wide Supervision Tools: Group-wide supervision tools within each jurisdiction are designed to ensure a complete view of an insurance group and the associated risks. Inter-jurisdictional cooperation is imperative and generally consists of supervisory colleges, crisis management groups, crisis management plans, bi- or multilateral discussions on focused issues, and ongoing informal conversations regarding supervisory approaches to asset-intensive insurers.

- Supervisory Intensity: The information flow is highly dependent on the knowledge and engagement of each individual supervisor, and proper review can require a high level of technical expertise. Therefore, the supervisory intensity in reviews of asset-intensive transactions is quite high. Supervisors recognise that traditional supervision may not be sufficient or appropriate to identify and address these differentiated asset- intensive risks.

- Collateral Requirements: Both assuming and ceding jurisdictions recognise the importance of collateral supporting AIR transactions. Many jurisdictions have collateral requirements in place to receive credit for reinsurance, at least for transactions that meet certain parameters or with counterparties in non-reciprocal jurisdictions. Some jurisdictions have guidelines to require the effectiveness of collateral and appropriate management of transactions conducted by insurers. Supervisors noted the importance of consistency and controls between the cedent’s own investment policy and asset management and investment agreements under a reinsurance treaty. Jurisdictions utilising the PPP approach to investment restrictions generally still apply to compliance with reinsured liabilities as well.

- Pre-approval Requirements: Many jurisdictions have or are implementing requirements for insurers to engage with supervisors before entering into new AIR arrangements, whether formal pre-approval or pre-review. This can cover key aspects of the arrangements such as counterparty risk assessment, safeguards and collateralisation, recapture risk, investment risk, and solvency and liquidity positions upon recapture in both base and stress scenarios. This process means that the Supervisors are to focus their attention on the investment-related components and adequacy of the collateral arrangements in mitigating counterparty risk of an AIR arrangement.

Supervisory Risk Assessment

Supervisors assess risks related to AIR, including counterparty, valuation, recapture, cross-jurisdictional, and financial stability risks.

- EU: AIR does not pose material financial stability risks due to its limited use within the European Economic Area (EEA). EIOPA is actively investigating the ongoing trends and potential risks associated with AIR, particularly the concentration of transactions in non-EEA jurisdictions and amongst a few reinsurers.

- US: The NAIC’s Macroprudential Working Group (MWG) monitors and discusses all the above-mentioned risks, including counterparty, valuation, recapture, cross-jurisdictional, and financial stability risks. The MWG regularly reviews US industry-wide reinsurance activity reports and considers appropriate actions based on these reviews. Currently, the MWG is considering the feasibility of implementing a micro and macro reinsurance risk dashboard covering key reinsurance risks and data points. Other considerations include a supervisor/regulator education programme, and a stock take of insurance company reinsurance reporting and disclosures.

- Bermuda: Bermuda has developed a tailored approach to address the unique risks posed by AIR, with an emphasis on governance, conflict of interest management, and risk management. Bermuda highlights the risks associated with investing in illiquid assets and the critical role of collateral arrangements in mitigating counterparty risks.

- Japan: Japan acknowledges the increasing number of AIR transactions with foreign reinsurers and the formation of strategic partnerships with PE firms. Japan points out the potential risks of concentration, conflicts of interest, and counterparty risk, emphasising the need for vigilance in monitoring these developments.

- Hong Kong: The risk associated with AIR is considered manageable due to its low prevalence and limited number of transactions. Common counterparty risk mitigation measures include the use of trusts and letters of credit.

- Singapore: Singapore is closely monitoring the increasing use of AIR domestically. Insurers entering into AIR transactions are required to perform comprehensive risk assessments, including evaluating counterparty risk, collateralisation, and recapture risk.

Overall, the IAIS notes that survey responses indicate that while the use of AIR varies across jurisdictions, there is a common emphasis on robust risk management frameworks, effective governance and the importance of collateral arrangements in mitigating counterparty risks.

Supervisory Enhancements

Jurisdictions have implemented or are considering enhancements to better supervise AIR, including pre-approval requirements, improved data collection and increased international cooperation.

- UK. The UK is a primary ceding jurisdiction, and has set out supervisory expectations for insurers holding or entering into AIR arrangements in the bulk purchase annuities market. Insurers must demonstrate that they can withstand recapture events involving highly correlated reinsurance counterparties. The UK is also performing a life insurance stress test in 2025 to consider the impact of an AIR recapture stress on its life insurers. The IAIS cites the Bank of England’s November 2024 Financial Stability Report, which also highlighted the emerging vulnerabilities at the intersection of private equity firms and life insurers making use of AIR arrangements and has encouraged increased international regulatory disclosure to measure the build-up of any systemic risks.

- EU. The European Insurance and Occupational Pensions Authority has aimed for enhancements to converge the EU’s approach to AIR, and has issued supervisory statements and opinions to address the risks associated with AIR. These include statements on the supervision of reinsurance with third-country undertakings (which highlighted the risk of the reinsurance provided by reinsurers operating in regimes not equivalent to Solvency II); the use of risk mitigation techniques (for example where there is a reduction in SCR not commensurate with the extent of the risk transferred); and the supervision of run-off undertakings (which, due to their idiosyncratic model, may have material counterparty risk).

- Bermuda. The IAIS notes that Bermuda’s enhancements in the last two years recognised its high number of asset-intensive reinsurers. Bermuda has introduced a prior approval process for all life reinsurance block transactions (which requires the submission of a wide range of information to assist supervisory review), enhanced capital requirements and the insurance liabilities framework (which has had a material impact on the total asset requirement, and insurer’s solvency), and introduced detailed liquidity risk management requirements (which broadened the definition of affiliated investments, capturing conflicts of interest, and enhanced reporting to improve visibility). Bermuda has also added resource to its supervision team, with relevant industry experience, to allow for more intense supervisory engagement. Bermuda is also consulting on two important proposals that will take effect in 2025 to (1) clarify supervisory expectations on compliance with the PPP and (2) to enhance the accessibility and granularity of asset and liability information for Bermuda’s long term insurers.

- US. The US is a primary ceding jurisdiction in the asset-intensive space and has implemented several initiatives with direct or indirect impacts on asset-intensive transactions. These include a reinsurance worksheet to aid supervisors in assessing the total asset requirement attribution. There is a current initiative under review which would require all material AIR transactions to be subject to some form of cash flow testing, whereby the insurer would demonstrate the adequacy of the assets in relation to the ceded reserves. In addition, the US intends for principles-based reserving for non-variable annuities (already in place for variable annuities and some life products), which could have an impact on future reinsurance volumes. Further, additional analysis and disclosure requirements for reinsurance transactions, is planned.

- Other jurisdictions: In addition, supervisors are in the information-gathering stage regarding trends in AIR and are considering additional supervisory material to provide examples on how supervisors could approach AIR transactions. Several are considering requiring pre-approval for such transactions to monitor growth and establish guidance based on observed treaty terms.

Macroprudential and Financial Stability Considerations

The IAIS also considers the macroprudential and financial stability implications of the structural shifts in the life insurance sector, particularly focusing on the increased investments in alternative assets and the adoption of AIR transactions. The IAIS Holistic Framework for Systemic Risk in Insurance identifies three primary transmission channels for systemic risk: asset liquidation, interconnectedness, and critical functions. Insurers, are generally considered to be countercyclical investors (holding assets in stressed markets, or being buyers when they fall). The IAIS notes that the empirical data is mixed, and insurers may be forced to liquidate assets during periods of stress, exacerbating market downturns.

Where the liabilities are reinsured via AIR, the IAIS notes, this risk would crystallise for reinsurers, who may have further issues managing liquidity given the potential collateral fungibility issues observed in some collateral structures, and their behaviours may therefore be more procyclical than traditional insurers.

The IAIS considers the risk for financial market disruption for a mass recapture event of AIR, noting the following:

- Should a market-wide liability-driven liquidity event or large-scale defaults and downgrades take place in certain alternative asset classes held in AIR collateral, reinsurers in the AIR market may see their financial condition deteriorate rapidly, triggering termination clauses in AIR arrangements.

- Insurers may also rush to recapture AIR to mitigate any further deterioration in the reinsurers’ financial condition.

- Should this result in a mass recapture of AIR transactions, insurers may find themselves recapturing large portfolios of alternative assets which they do not have the appetite or expertise to manage, which may also have a negative impact on regulatory capital.

- Insurers may therefore seek to rebalance their investment portfolios, selling illiquid alternative assets at steep discounts while purchasing liquid public assets rapidly.

- Such a market-wide rebalancing could destabilise financial markets, disrupting the flow of credit to corporates and impacting the real economy.

The growing interconnectedness of life insurers with other financial institutions through alternative asset markets creates potential contagion risks, amplifying systemic risk. The use of high leverage with respect to alternative assets, especially within certain funds structures, can increase the risk of defaults, magnify losses during downturns, and initiate or amplify fire sales of assets, driving down asset prices across the board. The IAIS notes that although the risk may be limited on a global level, jurisdictional concentrations of alternative assets may have a higher local impact. AIR transactions are concentrated among a few large insurers and jurisdictions, increasing systemic risk.

Furthermore, the growing involvement of private equity firms in the insurance sector (both through private equity ownership and associations such as direct allocations to private equity funds and/or private equity sponsored debt) can amplify systemic risks, with potential widespread impacts from, say, the failure of a large private equity funds or a general deterioration in private equity-sponsored firms.

The IAIS concludes that information gaps for alternative assets and AIR need to be addressed in order to monitor financial stability, and to allow supervisors to evaluate insurers’ global allocations and concentration risks. Increased alternative asset allocation and the use of AIR are leading to “herd behaviour” among insurers, where more insurers adopt similar asset allocation or reinsurance strategies to avoid losing competitive advantage. This collective behaviour could reinforce concentration risk and needs to be monitored.

To manage these evolving risks, ongoing collaboration and best practice exchanges among supervisors are flagged as a key part of the work.

Review of IAIS Supervisory Materials

The IAIS considered its own supervisory material in light of the structural shifts with respect to AIR transactions. The analysis aims to identify potential areas where the IAIS supervisory and supporting material could be enhanced to address the supervisory concerns arising from these trends. The review leverages insights from previous IAIS work and extensive feedback from external stakeholders, providing a thorough understanding of the issues.

The analysis finds that the Insurance Core Principles are broadly designed to encompass the various risks associated with alternative assets and AIR. However, it identifies several areas for potential enhancement. These include the following:

- Improving information sharing among supervisors, including from non-insurance supervisors (ICP 3).

- Managing conflicts of interest between insurers and other related parties (ICP 7).

- Ensuring competence and expertise in risk management, including increasing attention towards transactions with related parties on the asset side (ICP 8).

- Adapting supervisory review and reporting to better monitor complex assets and reinsurance agreements with additional liquidity, complexity and cross border and outsourcing reviews highlighted (ICP 9).2

- Adding additional criteria for supervisors to consider with respect to the suitability and impact of reinsurance programmes (ICP 13) to now focus on the particular features of an AIR. For example, assets, sidecars, concentrations, recapture, ongoing risk appetite and group-wide supervision.

- Addressing different jurisdictional approaches in valuing assets and liabilities for solvency purposes, which will include defining a market source hierarchy (ICP 14).

- Allocation of proper risk management to alternative assets relative to regulatory requirements regarding investments, which may include limits for excessive investment concentrations (ICP 15).

- Enhancements to an insurer’s ERM framework to be able to assess, amongst other things, interdependencies and cross-border exposure (ICP 16).

- Enhancing public disclosures to understand an insurer’s allocation to alternative assets, material transfers of risk and conflict, amongst other things (ICP 20).

- Enhanced macroprudential supervision but asking for additional data, assessing the risk of non-insurance legal entities, and concentration risk (ICP 24).

- Enhancing supervisory cooperation given the cross-border nature of reinsurance, including involving cedant jurisdiction supervisors during a crisis, and group-wide supervision coordination where there are complex reinsurance agreements (ICP 25).

Conclusion

The IAIS consultation paper provides a detailed analysis of the structural shifts in the life insurance sector with respect to the increasing allocation to alternative assets and the prevalence of AIR transactions. These trends offer significant benefits but are also said to introduce risks that require robust risk management and supervisory oversight. The IAIS proposes a principles-based definition of alternative assets and states a need for enhanced frameworks and international cooperation to manage the evolving risks.

The paper underscores the importance of macroprudential and financial stability considerations, given the interconnectedness of life insurers with other financial institutions and the potential contagion risks. The IAIS’ review of its supervisory materials aims to ensure that its supervisory approach remains effective in addressing the challenges posed by these structural shifts.

Overall, the IAIS consultation paper serves as an important step towards understanding the risks associated with the evolving investment strategies in the life insurance sector globally and how they may be managed. The IAIS encourages stakeholders to provide feedback on the draft paper to further refine its approach and ensure the stability and resilience of the global insurance market.

_______________

1 International Association of Insurance Supervisors, [Draft] Issues Paper on structural shifts in the life insurance sector, March 2025, Figure 4.

2 In the UK, the PRA has already issued a consultation paper with respect to enhanced liquidity reporting, CP19/24 which closes on 31 March. See our 24 January 2025 client alert “Policy Updates From the UK Prudential Regulation Authority.”

This memorandum is provided by Skadden, Arps, Slate, Meagher & Flom LLP and its affiliates for educational and informational purposes only and is not intended and should not be construed as legal advice. This memorandum is considered advertising under applicable state laws.