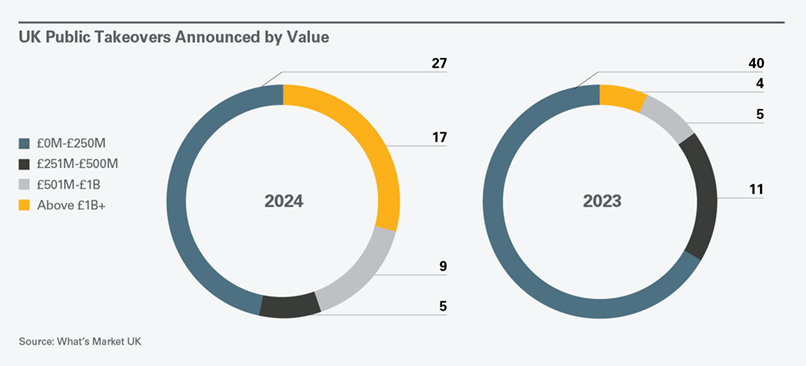

In 2024, in line with our predictions from last year, the UK public takeover market saw a sharp increase in the number of megadeals, i.e., those valued in excess of £1 billion. Seventeen such transactions were announced in 2024, which is over four times as many in 2023. The aggregate value of announced deals was over £50 billion, up from £19 billion in 2023, despite the fact that the number of firm offers remained similar, with 58 this past year compared to 60 in 2023.

There were still some lingering uncertainties in 2024 which may have acted as breaks on activity, for example:

- Political transitions: Significant elections were held in both the UK and US, and nearly half the world’s population lives in countries which held a national election in 2024.

- Macroeconomic instability: The inflation and interest rate outlook was unsettled.

- Global conflicts: The consequences of the expansion of conflict in the Middle East and the continued war in Ukraine were difficult to predict.

Whilst some of these issues will remain relevant in 2025, an uptick of activity at the end of 2024 suggests that increased political certainty and greater macroeconomic stability could drive M&A activity in 2025.

2025 Outlook

Elevated M&A activity: The M&A environment for 2025 looks positive overall. A stabilisation of interest rates should drive deal-making, presenting increased opportunities for strategic borrowing to finance acquisitions. Similarly, a trend of lower inflation should increase the confidence of potential buyers regarding the macroeconomic climate. The risks of global conflicts, particularly in the Middle East and Eastern Europe, have now been priced into the market and so are having less of an impact. Recent announcements by the UK antitrust regulator, the Competition and Markets Authority, have also indicated a possible change of approach, focussing on proportionality and recognising the need for growth, which may lead to fewer interventions and delays to deals.

In addition, larger deals may also continue to be fuelled by….

Share-for-share offers: A big driver of larger deals in 2024, which is expected to continue, is the use by bidders of their own stock as offer consideration. In 2024 there were 22 firm offers where all or a substantial part of the consideration was in the form of bidder securities. Across the year, the proportion of bidders offering all-share consideration increased to nearly 16% from 8% in 2023. The benefit of this approach for bidders is that they do not need to borrow in order to finance the acquisition. Target shareholders also benefit from being able to participate in the upside of the combined group, including potential synergies.

Elevated activity may also result from the….

Return of sponsor bidders: In stark contrast to the previous few years, UK public M&A activity in 2024 was dominated by strategic bidders, as opposed to financial sponsors, with strategics representing roughly two-thirds of firm offers. However, towards the end of the year, several public-to-private transactions (P2Ps) were announced. (Three out of four offers announced in October 2024 were P2Ps.) Financial sponsors may have been concerned earlier in the year that interest rates remained too high; with a continued downward trend in interest rates, they returned to the market, and it is hoped this will continue into 2025.

Key Statistics: 2024 vs. 2023

| UK PUBLIC TAKEOVERS ANNOUNCED | 2024 | 2023 |

|---|---|---|

| Firm offers | 58 (including one tender offer) | 60 (including one tender offer) |

| Schemes vs offers | 54 (93.1%) vs. 4 (6.9%) | 46 (76.7%) vs. 14 (23.3%) |

| Average deal value | £947 million | £325 million |

| Source: Source: What’s Market UK | ||

Whilst the number of firm offers remained relatively similar, the average deal value soared by roughly 291% as a result of the large increase in the number of megadeals evidenced in the chart below.

Schemes of arrangement were overwhelmingly the structure of choice for implementing UK public takeovers.

UK Public Takeovers Announced by Value

Takeover Code Changes

On 3 February 2025, changes to the Takeover Code will come into effect which will narrow the scope of companies which are subject to the Takeover Code. In particular, following a two-year transition period, the Takeover Code will cease to apply to unlisted public and private companies and will only apply to companies listed in the UK.

Trainee solicitor Cyrus Yazdanpanah contributed to this article.

This memorandum is provided by Skadden, Arps, Slate, Meagher & Flom LLP and its affiliates for educational and informational purposes only and is not intended and should not be construed as legal advice. This memorandum is considered advertising under applicable state laws.