The United Kingdom’s Competition and Markets Authority (CMA) will, in the new year, launch a review of its approach to merger remedies which could lead to a shift away from its long-standing preference for structural commitments in the form of divestitures as opposed to behavioural solutions. A further sign of a potential shift in approach came on 5 December, when the CMA accepted behavioural remedies for the first time in over four years in a merger in the mobile telecommunications sector. Will we see a “new year, new CMA”?

Key Takeaways

- The decision to launch the review takes place at a time when the government has sought to emphasise the UK’s investor-friendly, pro-growth environment and regulatory openness.

- While the review is unlikely to lead to a fundamental change in UK merger policy, there are indications that the CMA is becoming more open to accepting behavioural remedies in some cases, such as those which support growth by driving investment.

- A shift in approach on merger remedies could bring the CMA more in line with international counterpart authorities such as the European Commission (EC).

- Businesses seeking approval for complex transactions based on behavioural remedies should start the remedy planning process early and ensure that proposals are robust and comprehensive.

CMA Resolves To Reexamine Scope for Behavioural Remedies in Mergers

The chief executive of the CMA, Sarah Cardell, delivered a speech on 21 November which laid out how the CMA is rising to the challenge of driving growth for the UK economy. The speech announced that the authority would launch a review of its approach to merger remedies in the new year, as well as a new outreach series for investors and startups with a focus on mergers.

The CMA intends to look at when behavioural remedies may be appropriate (including whether this differs in regulated sectors) and what scope there is for remedies that lock in rivalry-enhancing efficiencies and preserve customer benefits that offset anti-competitive effects.

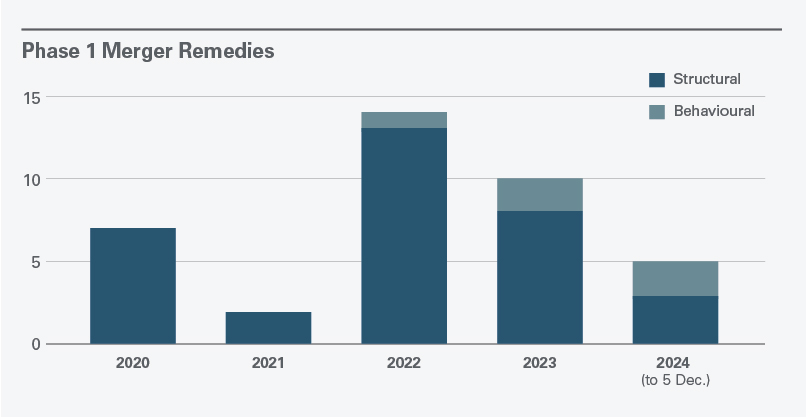

This announcement signals a potential rethink of the CMA’s past scepticism to behavioural merger remedies. The CMA has previously been clear that it strongly prefers structural solutions in the form of divestitures that are intended to permanently restore competition lost as a result of the merger by creating a new or strengthened player. Purely behavioural remedies — which relate to the ongoing conduct of the merged entity — are often viewed as less effective and too complex to administer. In the last five years, the CMA has accepted behavioural remedies in only a small proportion of Phase 1 cases and two Phase 2 reviews.

While behavioural remedies do play a role, they have been accepted only in limited circumstances — typically where structural remedies are not feasible, the harm arising from the merger is time-limited or sufficiently narrow, substantial relevant customer benefits will be preserved, or in regulated markets where conduct commitments can be overseen by the relevant sectoral regulator.

Recent transactions approved on the basis of behavioural remedies include those where the concerns related to a single housing site, a single tender and a single lease, and where there was uncertainty around the possibility of a suitable divestment purchaser. A number of transactions in the regulated rail sector have been approved subject to price caps limited to the duration of a rail franchise.

The CMA has previously rejected behavioural proposals outside of these limited circumstances. In its review of a high-profile transaction in the technology sector last year, the CMA rejected a simple cloud gaming licensing remedy that had already been accepted by the EC to remedy concerns in part of the transaction. This led to the CMA prohibiting the transaction, subsequent to which it allowed the parties to submit a restructured acquisition involving the permanent divestiture of cloud gaming rights to a third party and approved the amended transaction on that basis.

CMA Embraces the Government’s Growth Mission

The CMA’s decision to review its position on remedies takes place against the backdrop of the UK government’s mission to drive domestic investment and economic growth. In October, Prime Minister Keir Starmer specifically called on the CMA to prioritise growth, investment and innovation when taking decisions. The government published its Industrial Strategy Green Paper on the same day which, amongst other things, asked for views on the most significant barriers to investment that relate to competition, and how competition authorities can drive market dynamism to boost economic activity and growth.

The CMA has been quick to react. CMA officials have since publicly stressed that the authority’s existing strategy and work are pro-investment and a key driver of growth, consistent with the Labour government’s strategic aims. The CMA’s response to the government’s Industrial Strategy Green Paper pledged to use all its enforcement tools to promote growth and, in October, the CMA announced a new project that focuses on critical drivers and blockers of growth to support the government’s strategy.

Year-End Reflections and Early Signs of Change

There has been a recent change of tone on remedies from CMA officials. Sarah Cardell stated in her 21 November speech that “every deal that is capable of being cleared either unconditionally or with effective remedies should be”, and went on to underline that the CMA should be “straining every sinew” to test whether there is an effective remedy that can deliver customer benefits, including the benefits from growth and investment. This message departs from a speech delivered last year in which the chief executive underscored the authority’s hardline policy position on behavioural remedies as set out in its guidelines on merger remedies and past decisional-practice.

A potential shift in approach can also be observed in the CMA’s decisional practice. On 5 December, the CMA accepted a package of behavioural remedies in a four-to-three merger in the UK mobile telecommunications sector. The remedies, which are designed to heighten competition between the remaining operators, include a commitment to carry out network investments over an eight-year period supported by shorter-term customer protections requiring the merged company to cap certain mobile tariffs and offer preset wholesale contractual terms for a period of three years while the network investments are being deployed.

This decision, which represents the first behavioural remedies accepted at Phase 2 since March 2020, shows that the CMA is not always opposed to behavioural remedies that are novel, administratively complex or involve a degree of uncertainty. Further, even though this case concerns a regulated sector, transactions such as this which reduce the number of mobile network operators on the market from four to three have generally only been approved in Europe on the basis of structural remedies. (However, past cases show that third parties are not always willing to acquire divested assets or capable of effectively replacing the competition lost as a result of the merger.)

Out With the Old and in With the New?

We are unlikely to see a fundamental change in UK merger remedy policy as a result of the government’s Industrial Strategy. The CMA views its current enforcement approach as being already aligned with the government’s growth mission, and remains bound by the same statutory framework which requires it to achieve “as comprehensive a solution as is reasonable and practicable” to any competition concerns.

However, in cases where the CMA does identity competition concerns, it is suggesting a greater openness to accepting behavioural remedies to address them as well as accounting for competition-enhancing efficiencies and customer benefits such as those flowing from long-term infrastructure or technology investments. This will not be relevant in all UK merger reviews, but is likely to come into play in cases with a strong pro-growth, pro-investment rationale.

Recent reforms to the in-depth merger review process build in more flexibility to discuss remedies at an earlier stage of Phase 2 and, from 1 January 2025, new rules come into force which enable merger parties to agree with the CMA to extend the deadline of a Phase 2 review — all of which may allow more complex remedies to be considered and approved during an in-depth review.

There may also be scope for more innovative behavioural remedies in regulated sectors, particularly as the CMA’s upcoming review will consider whether any distinction should be made for regulated sectors when it comes to behavioural remedies.

Digital will be a key sector to watch. The UK government identified “digital and technologies” as one of the eight areas that it should focus on growing through its strategy. The CMA has previously expressed concerns that behavioural remedies do not work well in dynamic, fast-moving markets such as digital, leading it to reject behavioural remedies in favour of a structural solution or outright prohibition in some cases. Yet the incoming regulation for large tech platforms in the UK has the potential to positively impact the acceptability of behavioral remedies in digital markets. The CMA’s in-house digital team — the Digital Markets Unit — will soon start supervising the conduct of designated companies (which could include monitoring conduct-related promises), regulating the firms through bespoke codes of conduct (which could make foreclosure strategies less feasible) and making pro-competition interventions if markets are not working well (which might be a way of tackling issues once any behavioural remedy expires).

Health, Wealth and a Pro-Business Merger Regime?

The CMA has in the past been called overly interventionist in merger control compared to other authorities, leading to claims that “the UK is closed for business”. Sarah Cardell addressed this criticism in her 21 November speech, declaring that the CMA “must deliver a regime that leaves no one in any doubt that the UK is open to business”. While it is unlikely that this signals a broader softening of approach to merger control, it is notable that fewer Phase 2 mergers have been prohibited, unwound or abandoned in 2024 so far. It remains to be seen if this trend continues.

Takeaways for Businesses

The CMA’s decision to review its approach to merger remedies is a welcome development, as its strong pro-structural orthodoxy has become contentious.

An adjustment on remedies could bring the CMA more in line with its international counterparts such as the EC, as well as provide greater scope for international authorities reviewing the same transactions to align on remedies. This is important, as the UK has naturally become more actively involved in the consideration of global transactions since it left the European Union. However, while the EC has typically been more willing to consider and accept behavioural proposals, it has in the past been sceptical of investment remedies such as those recently approved by the CMA.

Businesses seeking approval for complex transactions conditional on behavioural remedies should start preparations early. The CMA will continue to require robust proposals to address any concerns, including where appropriate a well-evidenced case for preserving any customer benefits or generating rivalry-enhancing efficiencies.

Professional support lawyer Elizabeth Malik contributed to this article.

This memorandum is provided by Skadden, Arps, Slate, Meagher & Flom LLP and its affiliates for educational and informational purposes only and is not intended and should not be construed as legal advice. This memorandum is considered advertising under applicable state laws.