Summary

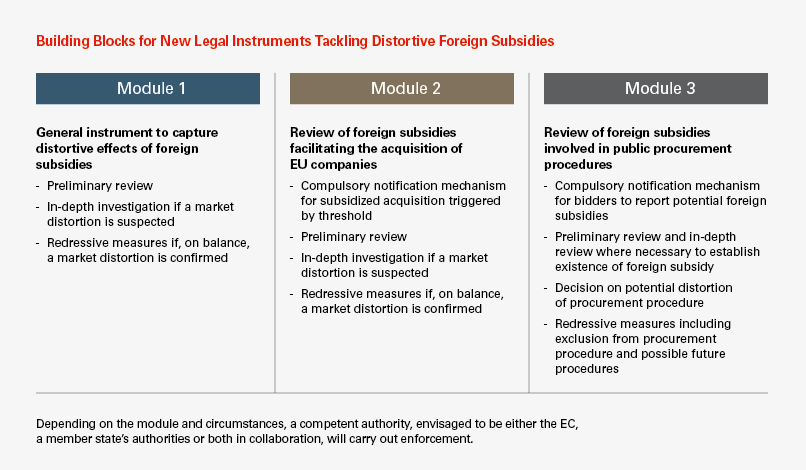

The European Commission (EC) has proposed far-reaching new powers to investigate and sanction foreign subsidies that have allegedly distortive effects on the European Union’s (EU) internal market.1 The proposals include:

(i) mandatory notification of acquisitions, including potentially minority investments, by companies receiving foreign subsidies. An acquisition is suspended pending the review, and may be prohibited or approved subject to conditions if found to be facilitated by distortive subsidies.

(ii) investigation of allegedly distortive foreign subsidies, with the power to order repayment of any distortive subsidy through “redressive payments” to the EU or member states as well as other behavioral or structural remedies.

(iii) a requirement that tenderers identify receipt of foreign subsidies in public procurement. The tendering authority would have the ability to investigate and exclude bidders if the subsidy renders the process unfair.

The EC has launched a public consultation on these proposals, which will remain open through September 23, 2020, with a plan to enact foreign subsidy legislation in 2021. While certain EU governments may oppose the wide-ranging measures proposed in the white paper, even a partial implementation will likely have a material impact on the legal framework for foreign investment in Europe.

The Scope of “Foreign Subsidies”

Foreign subsidies would be defined as any financial contribution by a non-EU public entity which confers a benefit to an economic operator active in the EU, giving the new tools unprecedented reach. The white paper considers that financial contribution can take various forms and may consist of:

- the transfer of funds or liabilities;

- foregone or noncollected public revenue, including preferential tax treatment or fiscal incentives such as tax credits; and

- the provision of goods or services or the purchase of goods and services.

In determining whether a financial contribution confers a benefit, the white paper proposes taking into account the usual investment practice factors, including investors, financing rates obtainable in the market, and adequate remuneration for a given good or service.

Module 1: Ex Post Monitoring and Remedying of Foreign Subsidies

The first proposal is to give the EC and the national competition authorities of EU member states the power to investigate any foreign subsidies that distort the internal market.

The proposals cover a two-stage investigation, initiated ex officio or upon a complaint. The new investigatory powers would apply to undertakings established in the EU that benefit from foreign subsidies, and potentially also to certain undertakings otherwise active in the EU that benefit from foreign subsidies. Subsidies below €200,000 granted over a consecutive period of three years would be exempted.

Stage one would involve a preliminary review to examine whether a foreign subsidy may distort the internal market. Certain defined types of subsidies would be considered likely to cause distortive effects, e.g., export subsidies, subsidies to ailing firms, unlimited guarantees, tax reliefs and subsidies directly facilitating an acquisition. Foreign subsidies not falling under these categories would still be assessed for their potentially distortive character along the following nonexhaustive criteria: subsidy size, undertaking size, market structure, and market conduct and activity level of the undertaking. Consideration would also be given as to whether the beneficiary has any privileged access to its domestic market.

Stage two would involve an in-depth investigation and also consider whether the subsidy had a positive impact within the EU that could outweigh any distortion. Positive effects would be defined widely and include employment, environmental considerations and digital transformation, among others. Only if this EU interest test showed that the positive effects of the subsidy do not mitigate the distortions in the internal market would the competent authority impose measures to remedy those distortions.

An in-depth investigation would be closed with either no action or subject to remedies. As under the EU state aid rules, remedies would aim to neutralize the distortive effect of the aid by the reimbursement of the aid (with interest) to the member state that granted it. For foreign subsidies, the white paper similarly proposes “redressive payments” to the EU or to member states. It also considers various possible alternative remedies including prohibition of investments, divestment of assets, third-party access rights, conduct requirements or prohibition of certain conduct.

Taking further inspiration from the EC’s existing merger control, state aid and antitrust enforcement regimes, the EC and national competition authorities would be given all the necessary investigatory powers to enforce the rules. Alleged beneficiaries that do not cooperate could face fines and periodic penalty payments. Also sanctions could be established for parties not supplying information or supplying incomplete, incorrect or misleading information. Moreover, authorities would be empowered to carry out fact-finding visits to the EU premises of alleged beneficiaries.

Module 2: Ex Ante Review of Acquisitions of EU Targets Facilitated by Foreign Subsidies

The second proposal seeks to address foreign subsidies that may lead to excessive purchase prices (e.g., outbidding) in the context of an acquisition of shares or assets in an EU-based business and that thereby prevent nonsubsidized acquisitions from achieving efficiency gains or accessing key technologies. Module 2 introduces a new merger control tool that would complement Module 1 by ensuring that foreign subsidies do not confer an unfair benefit on undertakings acquiring stakes in EU companies.

Companies benefiting from foreign subsidies above certain thresholds would need to notify acquisitions of shares or assets in EU companies to the EC. The white paper proposes a new mandatory preclosing notification regime to the EC, which would have exclusive jurisdiction under a one-stop-shop system. The regime would be entirely separate from the EU’s existing merger control competition regime.

Module 2 would capture foreign subsidies regardless of whether they are linked directly to a given acquisition or indirectly by increasing the financial strength of the acquirer. The white paper proposes to consider foreign subsidies in connection with a given transaction based on a limited timeframe, for example, those occurring in the three years prior to notification and the post-closing year.

Regarding requirements for notification, we expect the legislative process will clarify how widely the net will be cast. At this preliminary stage, the white paper suggests a fairly expansive approach, including certain minority acquisitions and providing for a combination of quantitative and qualitative thresholds. Module 2 would cover all acquisitions, directly or indirectly, of “control” involving more than a threshold percentage of shares or voting rights, or of “material influence” in an undertaking established in the EU. In terms of thresholds, possibilities include a €100 million target revenue threshold, a threshold regarding the value of the foreign subsidy, the value of the acquisition, or both, and more qualitative approaches, e.g., for assets likely to generate significant EU turnover in the future.

Provided that jurisdictional thresholds are met, the EC would investigate if the acquisition (i) would be “facilitated” by a foreign subsidy, and (ii) would result in a distortion of the EU internal market. To determine if such a distortion had occurred or would likely occur, the acquisition would be assessed according to the following criteria: subsidy size, situation of the beneficiary (including size in the EU), market structure, and level of activity in the internal market. Whether the beneficiary has any privileged access to its domestic market would also be considered. As under Module 1, the established distortion would then be balanced against the positive impact that the investment might have within the EU or on public policy interests recognized by the EU.

While separate and based on different jurisdictional and substantive legal thresholds, the proposed review procedure would be similar to the current EU merger control procedure. The acquirer would be obliged to file a notification and a bar on closing would apply pending approval. The procedure would also consist of two stages: a preliminary review phase and, where relevant, an in-depth investigation. Strict time limits would apply, and companies failing to notify would be subject to sanctions, including the risk of having completed transactions blocked and unwound.

At the end of an in-depth investigation, an acquisition might be approved, approved subject to remedies/conditions or prohibited. A broad range of structural and behavioral remedies are possible, similar to the Module 1 options. However, the white paper notes that redressive payments might not be suitable under Module 2, as the focus of commitments is likely to be on structural remedies.

Module 3: Foreign Subsidies in the Context of EU Public Procurement Procedures

The white paper also sets out ways to address the potential harmful effect of foreign subsidies on the conduct of public procurement procedures in the EU. A bidder would be required to notify the contracting authority if the bidder had received financial contributions from non-EU countries. The relevant contracting and supervisory authorities would then assess whether such contributions constitute a foreign subsidy and whether the contributions would render the procurement procedure unfair, in which latter case, the subsidized bidder would be excluded from the public procurement procedure.

Foreign Subsidies in the Context of EU Funding

Lastly, the white paper sets out its proposals to address the issue of foreign subsidies in the case of applications for EU financial support. Economic operators should compete for EU financial support on an equal footing and EU funding should not contribute to favor companies that receive distorting foreign subsidies. The white paper’s proposals seeking to prevent such an unfair advantage include implementing a procedure similar to the EU public procurement measures seen in Module 3. Further, the proposals set out ways to ensure that international financial institutions that implement EU-budget-supported projects, such as the European Investment Bank, mirror the EC’s approach to foreign subsidies.

Next Steps

The EC has invited comments on the white paper through an open public consultation running through September 23, 2020. The results will shape the new legal instrument the EC intends to introduce in 2021, which will need to move through the EU legislative procedure, giving the EU member states (through the EU council) as well as the EU Parliament extensive possibility to weigh in.

A qualified majority of member states would need to approve the measures in the European Council, which may prove to be challenging. The proposals are said to address an internal market enforcement gap in relation to the potentially distortive effect of foreign subsidies that might result in unfair competition, or unfair competition to acquire EU businesses, not regulated by the existing corpus of state aid, merger control or trade defense measures. Nonetheless the potential for extraterritorial effect — potentially shutting out foreign-subsidized businesses from investment or other opportunities in the EU — has the potential to be politically highly charged.

If and when new rules will be adopted, as well as their exact scope, remains to be seen. Many of the concepts proposed in the white paper will need elaboration and likely result in challenging political negotiations: for example, where to draw the line for notifiable transactions in Module 2; how competences will be shared between the EC and member state authorities; how a “distortion” will be defined; and what the legal requirements will be for the EU interest test. Also the notion of foreign subsidies and how to identify (let alone quantify) them will require elaboration. Significant debate among member states can be expected on those issues.

Potential Implications

If enacted, the proposed new rules are expected to lead to:

- Increased regulatory risk and burden for foreign companies operating or investing in the EU. International players, particularly those companies with strong support from governments in their domestic jurisdictions, will have to assess the additional legal risks of this new regime. The proposals will be of particular concern to companies based in the U.S., China and a post-Brexit U.K. with high levels of foreign direct investment in the EU. Companies receiving support from any of the EU’s other large trading partners, such as Russia, Turkey, Japan, Korea and India, may also be affected.

- Added complexity to the regulatory path of M&A transactions involving EU targets. In addition to complying with merger control rules and already bolstered regulation related to national foreign investment regimes, international transactions may require a separate preclosing “foreign subsidies” notification and approval in the EU or, even absent such approval requirement, face the risk of an ex post investigation into the effects of such subsidies.

- Increased regulatory uncertainty for international players operating in the EU, even absent a transaction. Companies would need to closely monitor any received foreign subsidies to assess and anticipate exposure under the new rules in the ordinary course of business, including when participating in tender procedures in the EU or applying for EU funds. The new rules may also open up a new battleground for strategic complaints by global competitors.

1 See https://ec.europa.eu/competition/international/overview/foreign_subsidies_white_paper.pdf.

This memorandum is provided by Skadden, Arps, Slate, Meagher & Flom LLP and its affiliates for educational and informational purposes only and is not intended and should not be construed as legal advice. This memorandum is considered advertising under applicable state laws.